Banana Republic Corruption

The Ayanda Capital contract to supply £250 million of PPE to the NHS has not caused anything like the stir it should, because UK citizens appear to have come to accept that we live in a country with a Banana Republic system of capitalism. I suppose when you have a Prime Minister who handed out £60 million of public money for a Garden Bridge that there was no chance would ever be built, and who had no qualms about directing public funds to one of his many mistresses, the norm has changed.

But the Ayanda Capital PPE deal represents all that is wrong with UK capitalism.

Ayanda Capital self-describes as a “family office”. It essentially carries out investment and financial engineering, including tax avoidance, for the private wealth of the Horlick family. “Family office” has a very specific meaning in the City of London. The best simple definition I could find is here:

Family offices are private wealth management advisory firms that serve ultra-high-net-worth (UHNW) investors. They are different from traditional wealth management shops in that they offer a total outsourced solution to managing the financial and investment side of an affluent individual or family.

Sometimes family offices invest the wealth of more than one “very high net worth” individual or family, but they do not invest or raise funds from the wider public or from institutions.

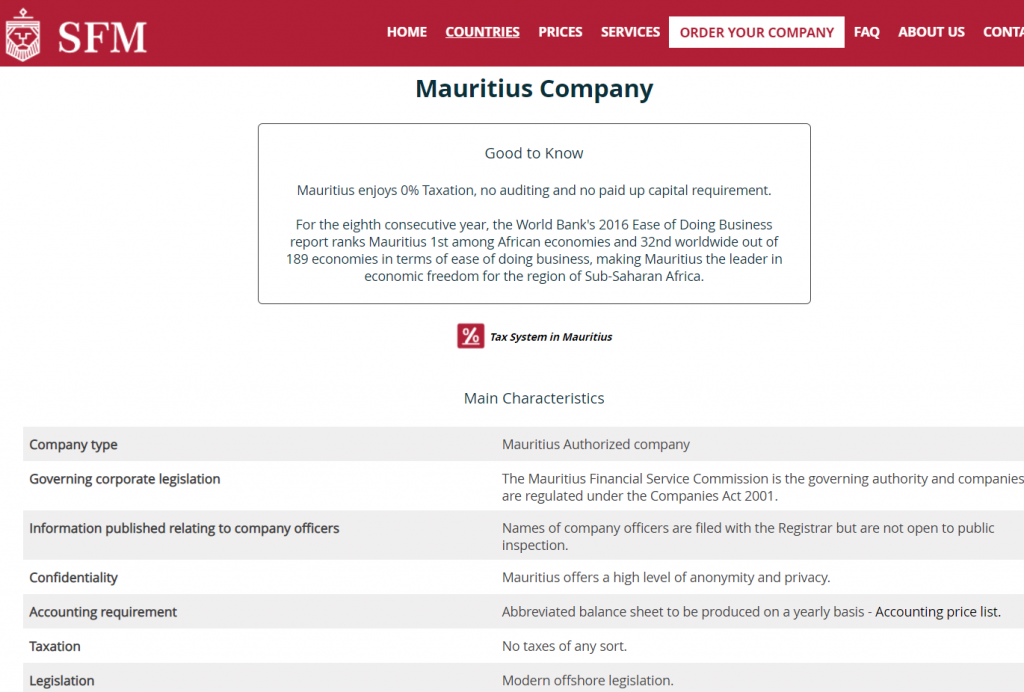

The only named “person with significant control” of Ayanda Capital is Timothy Piers Horlick, but he owns it through a Mauritius company. Mauritius is now a notorious tax haven; it offers zero tax and keeps company officers and owners secret.

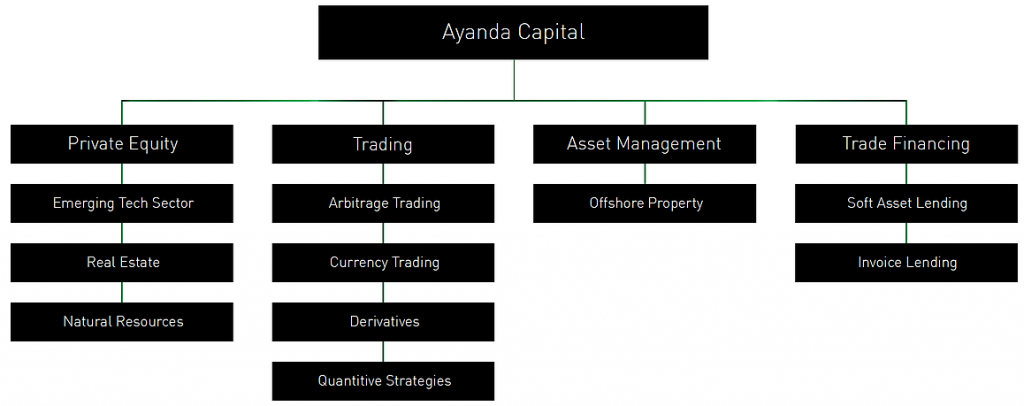

There is no reason to suppose that the activities of Ayanda Capital in private wealth management were illegal, or any more than part of the execrable trend of late stage capitalism towards super concentration of capital assets into private hands and away from the traditional more distributed forms of institutional and shareholder ownership. What Ayanda does is plain enough from its website:

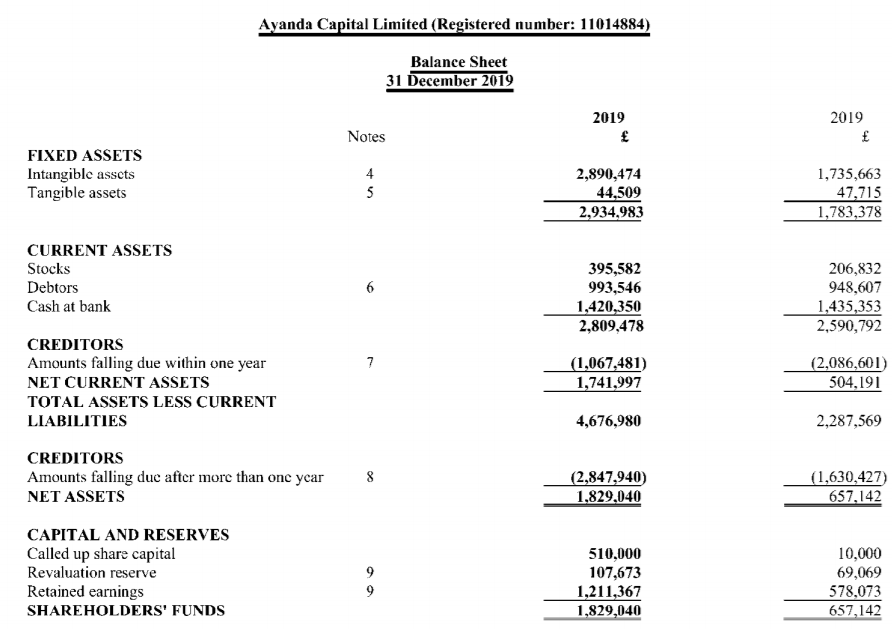

As you would expect from that profile, Ayanda Capital itself, rather than the wealth it invests, is little more than a shell company. It has two directors, Nathan Philip Engelbrecht and Timothy Piers Horlick. In fact, in December 2019, Ayanda Capital’s balance sheet shows that it was only kept from bankruptcy by “intangible assets” worth £2,890,000. That was an increase of almost exactly £2,000,000 in the value of those “intangible assets” in twelve months, allegedly due to “development” spending of that amount. What was being developed is entirely unclear. It is difficult to see how a private wealth investment company develops some form of intangible asset with a value of nearly £3 million. I find it hard to see all that as more than an accounting wheeze – and a rather hoary one at that.

So far, so unremarkable. So the question is this. Why would the NHS turn to this ethically sordid but zeitgeist banal private wealth management office to provide a quarter of a billion pounds worth of PPE to the NHS? Wealth Manager magazine, who have done excellent journalism on this story, have the contract as supplying only face masks. They have confirmed the astonishing fact that there was no published tender for the quarter billion pound contract. Normal tendering processes were suspended in March through secondary legislation at Westminster for the Covid-19 Crisis.

This is all simply astonishing.

The normal public procurement tendering process has pre-qualification criteria which companies have to meet. These will normally include so many years of experience in the specific sector, employment of suitably qualified staff, possession of the required physical infrastructure and a measure of financial stability. This is perhaps obvious – otherwise you or I could simply stick in a bid to build the HS2 railway that is £10 billion cheaper than anybody else, win the contract then go and look for a builder.

Ayanda Capital would fail every single test in normal procurement criteria to supply PPE to the NHS. I can see no evidence that anybody in the company had ever seen PPE except when visiting the dentist. They appear to have no medical expertise, no established medical procurement network, no quality control inspection ability, no overseas shipment agents, no warehousing or logistics facilities. We have of course seen this before from these crooked Tories with their “emergency procurement”, with the “ferry company” with no ferries. But this – a quarter of a billion pounds – is on a whole different level.

I understand that normal procurement chains were struggling, but I would still trust any of the UK’s numerous long established and globally successful medical supply companies to go out and get the right kind of medical supplies, of the right quality, and arrange their supply and delivery, rather than throw an incredible sum of taxpayers’ cash at the first couple of City wide boys who said they can do it. From a company with a very dodgy balance sheet.

What are Ayanda Capital in this transaction other than the classic Banana Republic “Mr 10%”? Precisely what kind of country has the UK become? No wonder it is falling apart.

——————————————

Unlike our adversaries including the Integrity Initiative, the 77th Brigade, Bellingcat, the Atlantic Council and hundreds of other warmongering propaganda operations, this blog has no source of state, corporate or institutional finance whatsoever. It runs entirely on voluntary subscriptions from its readers – many of whom do not necessarily agree with the every article, but welcome the alternative voice, insider information and debate.

Subscriptions to keep this blog going are gratefully received.

Choose subscription amount from dropdown box:

Paypal address for one-off donations: [email protected]

Alternatively by bank transfer or standing order:

Account name

MURRAY CJ

Account number 3 2 1 5 0 9 6 2

Sort code 6 0 – 4 0 – 0 5

IBAN GB98NWBK60400532150962

BIC NWBKGB2L

Bank address Natwest, PO Box 414, 38 Strand, London, WC2H 5JB

Subscriptions are still preferred to donations as I can’t run the blog without some certainty of future income, but I understand why some people prefer not to commit to that.