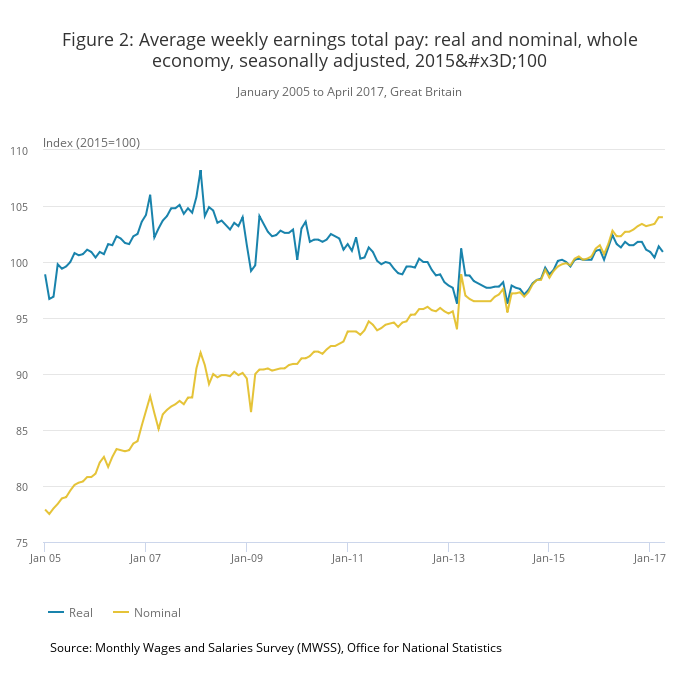

This is an astonishing truth. Average real wages in the UK today are worth 5% less than they were precisely a decade ago. This chart is from the Office of National Statistics.

I often see wage stagnation referenced in the media. It is only stagnation if your baseline is post bank crash. If your baseline is a decade ago, it is not stagnation but collapse. This is the worst decade for real wages since at least 1814-24, and I would argue this is worse than that. It is also worth noting that sharp recession also was triggered by a reduction in public spending, albeit from much lower levels.

One constant theme from the Labour Party in the election campaign, which gained traction, is that the last Labour government did not overspend. It was the banking crisis which crashed the economy.

Up to a point. The last Labour government did in fact overspend disastrously. But not on public services. Brown and Darling overspent on pumping incredible amounts of public money into bailing out the banks. That is what caused the initial massive inflation of public debt. The huge irony is of course that the interest on the debt is paid to – the same bankers who received the money as a bailout.

It is fashionable for right wingers to argue that the bank bailouts somehow did not really happen, or did not really cost anything. That rewriting of history is gaining much strength in mainstream media narrative. But the National Debt was 36% of GDP in 2007 (and on a downward trend) but leapt to 60% of GDP by 2009. That was the bank bailout.

The bank crash bailout triggered the austerity policies designed to repair the public finances, but which stifled economic growth. The lack of growth allied to neo-liberal deregulation of the labour market, and in particular the massive diminution in the role of unions, have caused the collapse in wages.

The government is fond of claiming that in this period the income gap between the top 10% of earners and the bottom 10% has shrunk slightly. That does appear to be true. But it is not the key figure. The gap between the top 1% of earners and the bottom 99% of earners has more than doubled during this decade. What has happened is that society has returned towards a more Victorian model. One per cent are super rich, everybody else is getting poorer and differentials are slightly shrinking.

It particularly interests me that the income disaster for ordinary people has been worse and more sustained than it was following the financial disaster of the 1930’s.

I opposed the bank bailout at the time, and I am now convinced that I was right. The bad banks should have been allowed to crash.

For the government to give people and companies their cash under the deposit guarantee scheme would have cost the public purse less than 10% of the money spent on the bank bailout.

The property bubble would have collapsed, making property realistically valued in relation to earnings and avoiding the landlord/tenant society we are becoming.

Bad bankers would have lost their jobs and a salutary lesson have been learnt the hard way on banking practices – instead we have had the opposite effect where bankers now believe they can do anything and will always be bailed out. The bailout was a massive perverse incentive.

Crashed banks would have been taken over by other better run banks that had not crashed, or new banks would have arisen. This is how economies progress.

It is possible the immediate recession would have been deeper. Top end London property, Porsche sales, cocaine and lap dancing would all have taken big hits. But there would have followed the kind of strong and sustained recovery with real growth seen in all previous historical financial crashes, instead of this lengthy crippling pain.

There are of course many other factors affecting the economy, which makes it very hard to isolate the effect of the UK banking bailout. But in the same decade Germany, France and Italy have seen growth in real wages. Mistaken continuation of the attack on public spending has of course made the situation much worse. But given the disaster for ordinary people that has ensued and been with us so very long, I think it would be very difficult for anybody to argue that life would be worse had the bank bailout not happened.

It is remarkable to me that this root cause of so many of our woes is almost never referenced n the media nowadays.

New Labour were not only responsible for much of the financial deregulation that made the great crash possible. Policies such as the Public Finance Initiative were simply devices for pouring billions of pounds in public spending straight into the pockets of the bankers. To bail out their city friends with the money of everybody else required no thought from Darling and Brown. Lord Darling has of course been having a little money poured into his personal pocket from the bankers almost ever since. There is a special circle of Hell reserved for Brown and Darling.

Peculiarly, I have never seen the question asked anywhere. But please, knock yourself out with ideas. What do you think would have happened by now if the banks had been allowed to crash?

UPDATE

In response to a comment, I have looked at Icelandic real wage growth in this period. Iceland let banks fail. Of course its economy has different qualities to the UK, but there may nonetheless be some interest in the comparison. In fact, exactly as I postulated above might have happened in the UK, after a sharper initial downturn, real wages in Iceland then recovered extremely healthily, giving very strong overall real wage growth for the whole period.

source: tradingeconomics.com

NB this graph is measuring something different to the above UK graph. The UK graph is measuring the level of wages in constant 2015 real terms. The Iceland grow is measuring the rate of growth in real wages.

While the two economies not being entirely comparable, this cannot prove my thesis, it certainly does support it.

This is a very interesting posting from a blog which shares my belief that it is wrong to view globalisation and neo-liberal deregulation as tied together or part of the same process. Globalisation is good. Deregulation is bad.

Typo in paragraph 16: it should be PRIVATE Finance Initiative. If only it had been PUBLIC.

Thanks for fascinating analysis.

On Iceland: “very strong overall real wage growth for the whole period”

Over the period in your chart there’s no change at all over the period. The chart ends up just where it began.

The chart is showing rate of growth, not absolutes. Where the graph is dropping, it’s showing a slowing in the RATE of growth, not a drop in salaries. So the fact that the rate is similar in 2016 as at the start doesn’t mean that salaries are at a similar level.

I wonder if anyone else thinks the idea that banks function like a household that’s gone broke & needs the money that pays for our life services a totally fabricated narrative.

The banks create money in the system.

It’s clearly all part of some odd cult thats totally separated itself from reality, justifying it’s existence via some esotiric abstract modelling nobody could remotely relate to life. I don’t care if others don’t look close enough realy, Why should they care if it’s all mad? They are rich and largely self absorbed. …It’s increasingly clear nothing is being dealt with..

I associate economics with violence (and coinage was created for war) and I think as long as it dominates human life as it does this violence will continue. Abstracted value into some symbol, and we all run around it like idiots.

@ Craig … we spoke briefly at the Rally on Glasgow Green … this is an extract from a meeting in Kirkwall:

https://www.facebook.com/thescottishhand/videos/261066404305477/

There is more here:

https://www.facebook.com/thescottishhand/

Common sense at a human level – is that a bad place to start?

I worked in Switzerland in the nineties when the minimum wage was ChF4000 per month -more than £10.00/ hr. They have excellent benefits and pensions and this fuels their economy to be one of the most productive in the world. Low wage economies only create massive income and wealth inequalities. Since arriving in the Philippines ten years ago it is still possible to hire unskilled labour at 150-200 pesos (£3-5) per day nothing has changed for the low paid. The great transfer of manufacturing and call centres services to Asia has had zero impact for the 40-50 million poor in the Philippines who typically get 6 month work contracts so as to permit companies to avoid paying social security and health insurance for employees but the top twenty families that control every aspect of commerce have become obscenely wealthy and some now occupy positions in the Forbes top 100 list. So much for globalisation.

On the other hand the >12 million Philippine OFW’s return >$45B per year which helps the economy, funds better quality housing for their families, pays for better education and health care which they otherwise could not afford.

Thanks for once again highlighting a festering problem in the banking system that spans our globe, an international problems caused by the elite’s seeking to park their stale monies and don’t pay taxes.

When Chris Patten said the other day that people like him should pay more taxes and that Labours manifesto had some credible points, we heard a wet Tory in attack mode, but not a plan for change.

“It is possible the immediate recession would have been deeper. Top end London property, Porsche sales, cocaine and lap dancing would all have taken big hits.”

To all interested, read the accounts of Lucy Edwards and her husband peter Berlin, both shuffled billions of illicit money for Bennex worldwide in London, with Bank of America, the Bank of New York and HSBC being heavily implicated and found guilty.

Bennex is also linked to YBM Magnex a front company for one of Russia’s most powerful mafia bosses, Semen Mogilevic.

This from 1999

http://www.independent.co.uk/news/banking-scandal-engulfs-europe-1118106.html

Roberto Saviano in his book ‘Zero Zero Zero’, (a riveting read guaranteed) argues that western banks were running deficits all during the 1990’s and were bailed out by vast sums of trafficked monies from all sorts of crime syndicates and drug smugglers, they were upholding western statistics and the futile practises of off shoring, directing vast amounts of funds of ‘establishment’, large TNC ‘s and other companies, incl. major banks, past the exchequer’s scrutiny, monies that should have been taxed and supporting the state. I go one further, I would say that the exchequer is well aware of this, and other tax bypasses.

White collar crime that has seeped into the crevices of banking, finance and Government agencies, and has never been punished, nobody from HSBC has gone to prison for the monies, approx. 9 billion, they laundered.

House prices are overvalued by at least a third, more in London and other Metropolitan urban centres and we must expect a crash to happen. Don’t expect a Tory Government to change any of these fully functioning tax sieves, only a tax boycott by the public demanding change will have an impact, the tax system is holed and punctured like a worm riddled table leg trying to hold up the weight of our vital services.

More and more companies are feeding on public services today, taxpayers are being prepared for multiple privatisations and higher taxes, the general public is being prepared to become the cash cow for this, that and everything, whilst nothing is done to stop illicit funds, tax evasion, or secretive arms deals. The taxpayer should declare ‘no confidence’ in the Bank of England, the Corporation of London and the feeble exchequer, cause this can only go one way down our trousers……

You mention Mogilevich. he has fewer than six degrees of separation from Donald Trump, according to recent Twitter threads – see Adam Khan @Khanoisseur for many Trump Russian financial ties.

Transforming the banking system:

Labour don’t do anything really, much. Common sense of money needs to be undermined/changed. Rather than forcing a system (for some) of fundamentalist Darwinian “nature” (brutality). How about one which is based on a civil idea of humans? That wouldn’t subject most of us to this constant staged “battle for life”.

It’s sickening to behold. Those who perpetuate this form are the killers, are the monsters.

“fundamentalist Darwinian “nature” ”

Now that you mention Darwin, I know quite a few interesting snippets from his life. Such as he married his first cousin, they went on to have ten children, three died in childhood, and another three despite being in long term marriages had no children, so much for Darwin practicising what he preached, evolution. ?

Incidently Darwin’s wife was Emma Wedgewood, grandaughter of the renowed potter, Josaih Wedgewood.

They all look the same to me ROS 🙂

Agents.

O/T but rather interesting, as the SAS, is accused of alleged torture and murder of civilians in Afghanistan.

http://www.independent.co.uk/news/uk/home-news/sas-special-air-service-war-crimes-civilians-cover-up-ministry-of-defence-operation-northmoor-royal-a7819006.html

I think the SAS brand became tainted when British politicians involved them in with illegal wars after 9/11 for the benefit of the US and Israel. With unaccountability, illegal wars and a license to kill atrocities were bound to follow. Their mystique had already been damaged by those who showed themselves as ex-members to promote books and earn TV cash. I used to watch programmes about them but not anymore.

Irish citizens in UK to lose rights after Brexit, well according to this they have.

https://mobile.twitter.com/SimonFRCox/status/881425032106450944

The solution is for the Republic to re-join the UK and Northern Ireland.

Gordon Brown gave the undeclared criteria for joining the Euro a codename called “his golden rule”, which was a formula for keeping public spending within certain limits (the austerity of its day). And this is why when the financial crisis began he was slow to nationalise Northern Rock to prevent a run on the banks. Finally he agreed to nationalise Northern Rock and the day before he did so, he announced he was abandoning his “golden rule” to avoid this mainstay of New Labour economic policy (to join the Euro) being broken!

Whilst Bill Mitchell may share your belief on globalisation/neo-liberalism he does not share your view on the EU which he regards as a “right wing corporatist failure”!

I agree.

http://bilbo.economicoutlook.net/blog/?p=35711

We Have to Stop Arming the Saudis http://novaramedia.com/2017/06/14/we-have-to-stop-arming-the-saudis/

“The bad banks should have been allowed to crash.”

Given what we now know, this would not have included Barclays, who ‘fiddled’ figures and strong armed Qatar!

As private companies they all should have been allowed to go bankrupt and from the ashes we should have created a better system than the Rothschild usury we all use!

No they did’nt they were the only bank not to take money from the state.

They ‘created’ their own money?

“Since banks invent money as fictitious deposits, it can be readily shown that capital adequacy based bank regulation does not have to restrict bank activity: banks can create money and hence can arrange for money to be made available to purchase newly issued shares that increase their bank capital. In other words, banks could simply invent the money that is then used to increase their capital. This is what Barclays Bank did in 2008, in order to avoid the use of tax money to shore up the bank’s capital: Barclays ‘raised’ £5.8 bn in new equity from Gulf sovereign wealth investors — by, it has transpired, lending them the money! As is explained in Werner (2014a), Barclays implemented a standard loan operation, thus inventing the £5.8 bn deposit ‘lent’ to the investor. This deposit was then used to ‘purchase’ the newly issued Barclays shares. Thus in this case the bank liability originating from the bank loan to the Gulf investor transmuted from (1) an accounts payable liability to (2) a customer deposit liability, to finally end up as (3) equity — another category on the liability side of the bank’s balance sheet. Effectively, Barclays invented its own capital. This certainly was cheaper for the UK tax payer than using tax money. As publicly listed companies in general are not allowed to lend money to firms for the purpose of buying their stocks, it was not in conformity with the Companies Act 2006 (Section 678, Prohibition of assistance for acquisition of shares in public company).”

http://www.sciencedirect.com/science/article/pii/S1057521914001434

Unfortunately deregulation and ‘globalisation’ are two sides of the same coin. So called globalistion agreements are simply investor rights arrangements, locking in predatory intellectual property rights and other coprorate goals. What’s counted as ‘trade’ are largely transfers within corporate entities. So when GM or BP move goods from one arm of their business to another in a different country it’s counted as ‘trade.’

Real international trade has probably declined since the neo-liberal, globalised era began.

I broadly agree with your issue here Craig – but letting the banks crash would have had huge impact.

If 1 or 2 banks (e.g. RBS and HBOS/Halifax/Loyds) had been allowed to crash, its likely that would have triggered crashes in other banks and lead to a chain reaction running out of control as other banks failed as a results of bad debts and triggered further bank failures.

This would mean most people would fail to receive their salaries and or benefits, cash machines would have shutdown and card transactions would cease to go through. Although savings might be protected by the guarantee scheme, many people rely on salary and in any case would struggle to access the protected savings (queues forming at banks etc)

This would surely have a catastrophic effect on the UK economy – for a prolonged period as people ceased to trust banks and hoarded cash (this would also have accelerated the chain reaction, taking down more banks).

Whilst i think bailing out the banks in 2007 was unavoidable, it should have been followed by regulation to separate personal banking from the investment banking arms, preventing the shutdown of personal banking when an investment bank fails.

I’m not a financial expert – so i’d be interested if anyone feels there was an alternative result to allowing the banks to go bust.

Richard Murphy has always advocated other options in his blog. E.g. http://www.taxresearch.org.uk/Blog/2010/12/17/the-alternative-economic-policy-we-need/ There’s plenty more there as well, countering the neoliberal, country-as-household, mickey-mouse economic nonsense that so many economists subscribe to and virtually all (economically illiterate) politicians at Westminster also support – “our children and grandchildren will be paying this debt” etc etc. Hence Osborne’s disastrous reign.

Here is someone who agrees with you?

“Guarantees would have been the easiest form of intervention to present politically because they would have emphasised the true purpose of government assistance to the banking system: to prevent the savings of depositors – especially wholesale depositors such as corporations, foundations, savings institutions, and local governments. These depositors would have seen trillions of dollars in payrolls, pensions, and working capital evaporate if the banks were allowed to fail. Guarantees would have underlined the fact that the main beneficiaries of all bank rescues were not greedy bankers or shareholders but wholesale depositors whose money is not covered by retail guarantees.”

A. Kaletsky: Capitalism 4.0. P150.

Globalisation is good. Deregulation is bad.

I almost agree with this statement but I’m afraid it obscures the complexity of contemporary globilisation. For example, it fails to take account of the neo-liberal nature of contemporary globilisation and the ongoing development of theories of marginalisation. This is important, as the neo-liberal project aims to transform the nature of liberty through anti-social economic force. This is a state of fascism, frankly.

The secret adventures of order: globalization, education and transformative social justice learning

Abstract

There are many definitions of globalization, or perhaps more accurately, there are many globalizations. Discussing the four faces of globalization – globalization from above, globalization from below, the globalization of human rights, and the globalization of the war against terrorism – and their impacts on education and learning, this article offers an analysis of neoliberal globalization and how “competition-based reforms” affected educational policy in K-12 and higher education….

http://www.scielo.br/pdf/rbeped/v94n238/a02v94n238.pdf

Or to put it another way.

Perspectives on Globalization, Social Justice and Welfare

Although the social science literature on globalization has proliferated, social policy and social work scholars have not adequately debated the consequences of globalization for social welfare and social justice. Drawing on different social science interpretations of globalization, four major perspectives that offer different analytical and normative insights into globalization are identified and their implications for social welfare and social justice are briefly examined. The implications of these perspectives for social policy and social work scholarship are also considered

http://scholarworks.wmich.edu/cgi/viewcontent.cgi?article=3247&context=jssw

This person obviously comes from a good family. 🙂

Reforming Social Justice in Neoliberal Times

ABSTRACT This article unfolds in three stages. First, it locates the emergence of modern conceptions of social justice in industrializing Europe, and especially in the discovery of the “social,” which provided a particular idiom for the liberal democratic politics for most of the twentieth century. Second, the article links this particular conception of the social to the political rationalities of the postwar welfare state and the identity of the social citizen. Finally, the article discusses the myriad ways in which this legacy of the social and social justice has been disrupted, although not yet fully displaced, by the economic orthodoxies and individualization that inform the contemporary neoliberal governing project in Canada. The result, the article concludes, has been the institutionalization of insecurity, which demands the renewal of a social way of seeing and a politics of social justice on local and global scales.

https://brock.scholarsportal.info/journals/SSJ/article/viewFile/972/942

Does large print make dull bollocks more readable?

I think Craig has produced a very accurate summary of the facts.

I’m sorry you even have to ask. No. Indeed, you have it backwards… dull (sociological) bollocks makes large print less readable. 🙂

It’s a sorry fact that a large proportion of the electorate believes in a lottery economy, and it is expressed typically through discourse about house prices. There are millions of voters who, despite carping on about insane house prices, actually do not want a house price crash and want the opportunity, however remote, to climb on board and make lots of unearned income if the opportunity arose.

That’s what I mean by supporting a lottery economy. Even though the vast majority will never make a penny out of house price speculation, they believe that “one day” they will be able to cash in on house price inflation. In that regard it is the same fantasy that leads millions to buy lottery tickets even though the odds against winning are astronomical. So they let successive governments construct an economic system which allows static assets to inflate while otherwise useful investment is diverted away from productive activity in favour of asset bubbles. Everyone knows it is catastrophic in the long run, but, who knows, so they believe, maybe one day they will get lucky in the short term.

” There are millions of voters who, despite carping on about insane house prices, actually do not want a house price crash ”

Two words:- negative equity.

A lot of people are relying on equity release or downsizing to part fund their retirement.

I just think it’s sad. There are a whole bunch of people who genuinely seem to think that ever-rising house prices is some sort of human-right, like healthcare, and the internet. So they vote for the Greedy Party, who promises policies to ensure they have a wealthy retirement. Seems to be a lot of people simply haven’t done their research – and thus deserve to get hosed.

I very briefly looked into the scam, just out of curiosity, and swiftly saw it was a) a ponzi scheme, b) a tax rort. I’m no Maynard Keynes, you can be sure, but I just shake my head in amazement that this scam is being allowed to continue. It has the potential to screw everyone, hard. It’s a subject that annoys me greatly, because it’s an entirely avoidable fuck up – but when it fucks up, the rentier class will just say ‘nobody could have seen it coming’, and the rest of us will be forced to bail them out. Infuriating.

Also, my rent was just raised. Not by much, but it’s not the money, it’s the principle. Reason given: ‘due to high demand for rents’.

Die. Die. Die. Rentier State.

“There are a whole bunch of people who genuinely seem to think that ever-rising house prices is some sort of human-right”

Indeed so, and that’s really the point I made in a different way. But it’s not just Tories who cling to this view. Over the past twenty five years, many people I know who have voted either Liberal or Labour have attempted to make pots of cash from flipping properties, Sadly it seems to be deeply embedded into the modus operandum of a huge number of Brits. At the same time they nod gravely when someone else suggests asset bubbles have reached ludicrous levels. But they still try their luck.

Fractional Reserve Banking is the modern alchemy that turns lead into gold and the globalist cabal’s influence is due to their control of the PRIVATE US Federal Reserve that controls the world’s money supply. New Labour’s deregulation gave them more power because it made it politically easier for the US to deregulate further too.

And no mention of immigration in the figures and yet the apologists repeatedly say immigration is “good for the economy”!

‘They’ were following the ‘example’ of the U.S?

“But this is evasion and deception. The mass immigration of the past decade wasn’t caused just by the absence of transitional controls on new EU member states. It was the result of a policy of encouraging immigration to generate economic growth – a policy NuLab copied from Bill Clinton’s America. In a speech about the policy, then Home Office minister Barbara Roche said:

‘The evidence shows that economically driven migration can bring substantial overall benefits both for growth and the economy. In the United States, as Federal Reserve Chairman Alan Greenspan has commented, the huge recent inflow of migrants – 11 million in the 1990s – has been key to sustaining America’s longest-ever economic boom.’”

http://www.lobster-magazine.co.uk/free/lobster68/lob68-view-from-the-bridge.pdf

The interesting question arising from this is: what globalist model can be reconciled with regulation (and with that, a central global regulator, and central global compliance enforcement?)

More UK nurses and midwives leaving than joining profession

http://www.bbc.co.uk/news/health-40476867

‘The number registered in the UK fell by 1,783 to 690,773, in the year to March.

The Nursing and Midwifery Council (NMC) said the downward trend had been most pronounced among British workers. Many leavers cited working conditions.

But the government said there were now 13,000 more nurses working in England than in 2010.

In April and May this year, there was a more dramatic fall in those leaving nursing and midwifery, with a further 3,264 workers going. Other than retirement, the main reasons given for leaving were working conditions – including staffing levels and workload – personal circumstances and disillusion with quality of care to patients, according to an NMC survey of more than 4,500 leavers.

Other reasons included leaving the UK and poor pay and benefits.’

In September, new applicants for training will have to take out loans.

OUR NHS, to which many of us owe our lives, is being systematically destroyed piece by piece.

I just heard a nurse on James O’Brien’s phone in on LBC earlier. She has been qualified as a nurse for 10 years but because ALL of her salary is absorbed by childcare costs, she is leaving to do an office job where she will earn more, work shorter hours and be in a workplace without the stresses. She also said she has seen a change in the public’s attitude over recent years – more demanding and less appreciative. She is distraught at leaving as she obviously loved her nursing job.

Craig,I am surprised that you missed the opportunity to blame Margaret Thatcher, because she was the instigator of the deregulation that led to the crash of 2008. Prior to her banks could not offer mortgages.

The prosperity we have enjoyed has been because we have all borrowed money and been spending it. much of it on housing. House prices go up and banks lend more ,because the asset price has increased.

All ran fairly smoothly apart from a blip known as the crash of 1987 until Gordon Brown started taking the piss and spending enthusiastically. He also pressurised the banks to continue lending foolishly despite the governor of the Bank of England warning that lending was out of control. The inevitable happened the banks crashed .

I remember it crystal clear , I remember being rung on a Friday by a banker from Fortis and being told that they were solvent. Over the weekend they were bailed out the Belgian state and on Monday the same banker told me that he had lied to me and knew the bank was on the verge of bankruptcy.

However, I agree with you Craig that the banks should have been allowed to go bust, but the consequences would have been dire in the short term. Most property owners would have owned an asset worth less than debt secured against it resulting in 100s of thousands bankruptcies. There really would have been starvation how would we have imported food etc.?

Having said that all Gordon Brown did by bailing out the banks was to shift the risk up from the banks to the state and double the National Debt from £500 billion to £ I trillion. Osborne continued and added another £500 billion.

The problem has not gone away , it has simply been brushed under the carpet of the National Debt and the next crisis will be states not banks going bust. It will make 2008 look like a walk in a pasture with a nice breeze.

We should have taken the hit in 2008, as you say.

I felt that although it would have been possible for ordinary savers to get their money from the deposit guarantee scheme it would have taken ages for the machinery to work. A lot of bad things would have happened to people in that period of wait. So, I think the bank bailout was the lesser evil. However, I do think that the banks should have been nationalized fully. It has been my point also that the banks have not really themselves paid back the debt, it is just part of what is creamed off as the money flows. It is the public who have paid the debt by sleight of hand. Banks do not create wealth.

And also remember that everything would be netted out ie if you had a £250,000 mortgage from RBS and £25,000 in savings at RBS you would lose your savings.

Yes, you are absolutely right. The banks should indeed have been allowed to fail. If I recall correctly, that was the original Conservative position, quickly reversed by Osborne. I’m sure none of us can imagine why he did that…..

In Norway, during the 1991-92 culmination of the bank crisis, the state had to bail out the three largest financial banks, DNB, Fokus Bank and Kreditkassen. And assumed ownership of the bankrupt banks.*

The previous stocks were annulled.

This were largely a success. Though some brass figures managed to siphon out “performance bonuses” based on bailout money (as the influx of state money rapidly improved the economy of the banks)!

In 2008 the NeoCon sickness sadly had influenced Norway too, and pouring money into the pockets of the gamblers were deemed the best choice of policy.

And invariably, pouring public money to gamblers means pooring the public!

* Usually referred to as “the Swedish model” in financial documents at the time, and not “the Nordic model” for some odd reason.