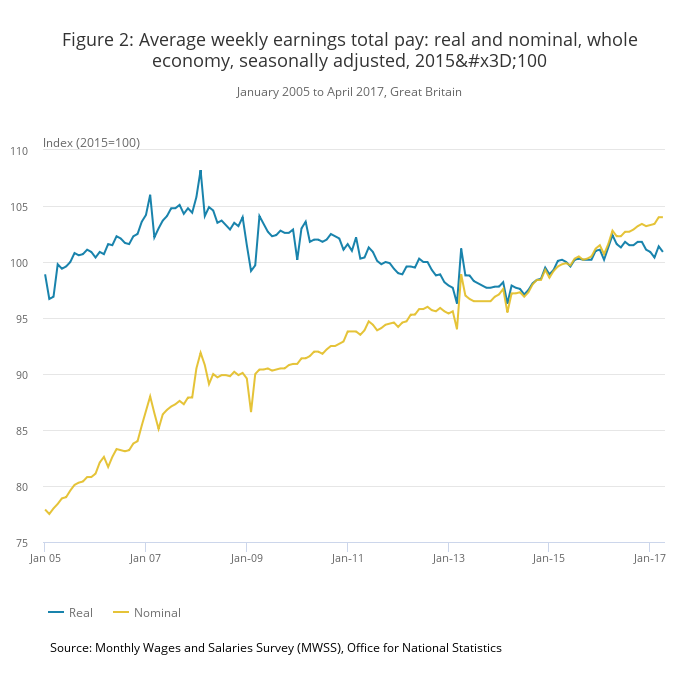

This is an astonishing truth. Average real wages in the UK today are worth 5% less than they were precisely a decade ago. This chart is from the Office of National Statistics.

I often see wage stagnation referenced in the media. It is only stagnation if your baseline is post bank crash. If your baseline is a decade ago, it is not stagnation but collapse. This is the worst decade for real wages since at least 1814-24, and I would argue this is worse than that. It is also worth noting that sharp recession also was triggered by a reduction in public spending, albeit from much lower levels.

One constant theme from the Labour Party in the election campaign, which gained traction, is that the last Labour government did not overspend. It was the banking crisis which crashed the economy.

Up to a point. The last Labour government did in fact overspend disastrously. But not on public services. Brown and Darling overspent on pumping incredible amounts of public money into bailing out the banks. That is what caused the initial massive inflation of public debt. The huge irony is of course that the interest on the debt is paid to – the same bankers who received the money as a bailout.

It is fashionable for right wingers to argue that the bank bailouts somehow did not really happen, or did not really cost anything. That rewriting of history is gaining much strength in mainstream media narrative. But the National Debt was 36% of GDP in 2007 (and on a downward trend) but leapt to 60% of GDP by 2009. That was the bank bailout.

The bank crash bailout triggered the austerity policies designed to repair the public finances, but which stifled economic growth. The lack of growth allied to neo-liberal deregulation of the labour market, and in particular the massive diminution in the role of unions, have caused the collapse in wages.

The government is fond of claiming that in this period the income gap between the top 10% of earners and the bottom 10% has shrunk slightly. That does appear to be true. But it is not the key figure. The gap between the top 1% of earners and the bottom 99% of earners has more than doubled during this decade. What has happened is that society has returned towards a more Victorian model. One per cent are super rich, everybody else is getting poorer and differentials are slightly shrinking.

It particularly interests me that the income disaster for ordinary people has been worse and more sustained than it was following the financial disaster of the 1930’s.

I opposed the bank bailout at the time, and I am now convinced that I was right. The bad banks should have been allowed to crash.

For the government to give people and companies their cash under the deposit guarantee scheme would have cost the public purse less than 10% of the money spent on the bank bailout.

The property bubble would have collapsed, making property realistically valued in relation to earnings and avoiding the landlord/tenant society we are becoming.

Bad bankers would have lost their jobs and a salutary lesson have been learnt the hard way on banking practices – instead we have had the opposite effect where bankers now believe they can do anything and will always be bailed out. The bailout was a massive perverse incentive.

Crashed banks would have been taken over by other better run banks that had not crashed, or new banks would have arisen. This is how economies progress.

It is possible the immediate recession would have been deeper. Top end London property, Porsche sales, cocaine and lap dancing would all have taken big hits. But there would have followed the kind of strong and sustained recovery with real growth seen in all previous historical financial crashes, instead of this lengthy crippling pain.

There are of course many other factors affecting the economy, which makes it very hard to isolate the effect of the UK banking bailout. But in the same decade Germany, France and Italy have seen growth in real wages. Mistaken continuation of the attack on public spending has of course made the situation much worse. But given the disaster for ordinary people that has ensued and been with us so very long, I think it would be very difficult for anybody to argue that life would be worse had the bank bailout not happened.

It is remarkable to me that this root cause of so many of our woes is almost never referenced n the media nowadays.

New Labour were not only responsible for much of the financial deregulation that made the great crash possible. Policies such as the Public Finance Initiative were simply devices for pouring billions of pounds in public spending straight into the pockets of the bankers. To bail out their city friends with the money of everybody else required no thought from Darling and Brown. Lord Darling has of course been having a little money poured into his personal pocket from the bankers almost ever since. There is a special circle of Hell reserved for Brown and Darling.

Peculiarly, I have never seen the question asked anywhere. But please, knock yourself out with ideas. What do you think would have happened by now if the banks had been allowed to crash?

UPDATE

In response to a comment, I have looked at Icelandic real wage growth in this period. Iceland let banks fail. Of course its economy has different qualities to the UK, but there may nonetheless be some interest in the comparison. In fact, exactly as I postulated above might have happened in the UK, after a sharper initial downturn, real wages in Iceland then recovered extremely healthily, giving very strong overall real wage growth for the whole period.

source: tradingeconomics.com

NB this graph is measuring something different to the above UK graph. The UK graph is measuring the level of wages in constant 2015 real terms. The Iceland grow is measuring the rate of growth in real wages.

While the two economies not being entirely comparable, this cannot prove my thesis, it certainly does support it.

This is a very interesting posting from a blog which shares my belief that it is wrong to view globalisation and neo-liberal deregulation as tied together or part of the same process. Globalisation is good. Deregulation is bad.

Yeah – wages on their arse

Concurrent with BEING A MEMBER of the EU

I suppose I’m really racist for pointing that out.

Yes, and wages are not on their arse in Germany and France because? (Germany and France have more immigration per head than we do, incidentally).

You probably are a racist.

Actually, anybody who can think about the vastly complex fiscal and financial questions briefly referenced here, and come up with the answer that it is all the fault of FOREIGNERS coming here, is not just a racist. They are a stupid bloody racist.

Just briefly, as I’m on the move… this is something I would like to have discussed at length!

*

It could be that Sean was simply pointing out that austerity policies have been peddled, if not foistered, by Germany on any country not following their neo-liberal economic policies closely enough. Yanis Varoufakis made that amply clear in his recent book (now out in paperback!) which is very well worth reading.

Britain needed no such prompting, because Cameron’s Tories were already well hip to that game, and more than eager to get in on it. Austerity for the poor, anyway.

*

About allowing banks to collapse… a difficult one. A run on one bank, then another, will collapse any institution regardless of its underlying health, because they cannot realise their assets overnight. Bad faith speculators can (and will) ruin any institution not solidly backed by an institution they simply cannot overwhelm, such as governments – at least, in larger and more stable countries.

If even one bank gets rolled over by speculators, it is massively more difficult to stop the domino effect ruining most if not all the major underpinnings of a country’s banking structure. Going after the smaller institutions then becomes a mopping up process.

Much as I despise them, allowing even one bank to actually go under in a major economy would be unwise. Prosecuting the banksters who exposed their institutions to such folly would be good indeed – “deregulation” is a euphemism for “decriminalisation”.

How is Iceland doing then?

You inspired me to find out. See above.

Of course, iceland is in the single market

Indeed iceland had a banking system 11 times the size of its GDP yet transformed it’s economy through stimulus, not austerity.

We are still in crisis actually. Private debt is still growing and stands at around £5 trillion – far higher than sovereign debt.

What should have happened was the direct bailout of debtors and depositors and not the city. This is still required. The treasury can sanction the purchase of one quarter of the uk’s sovereign debt via QE (there is no interest being paid on that) and it needs to enable the deleveraging of the private sector if there is to be a functioning economy.

The mainstream economists running the uk (and U.S) treasury still don’t understand that banks are creators of money and not money lenders. Loans create deposits. The uk is a wholly owned subsidiary of the city of london.

The banks should never have been bailed out. My opposition to that was always based on principle, not expediency — if everybody else has to abide by the laws of the free market jungle, the banks should too. A better solution would have been to let them collapse and nationalise them.

I like to think that it’s as clear to others as it is to me that all these problems we have faced in the UK since the start of the millennium can be attributed to a very narrow group of decision makers who have the same obnoxious values. When you talk about banks, politics, public inquiries, the media, and all the other levers on our lives, you’re talking about the same people.

To start with, I think we need an inquiry into public inquiries. Once we have recalibrated and fixed them, we should investigate the public schools that produce these monsters who play musical chairs at the top of society.

I would say the social system they are foisting upon us is more Medieval than Victorian.

The “mistaken continuation of the attack on public spending”. Sorry Craig, but can you show me the mistake that has been made that would counter their aims? Austerity is an umbrella word for for ideologically driven aims to enrich private enterprise. There has been no mistake in its calculated execution. They do it so well and will do so always.

Britain grasped the nettle.

Italy didn’t.

http://www.telegraph.co.uk/business/2017/06/26/italy-commits-17bn-rescue-two-stricken-banks/

How did “Britain grasp the nettle”? The nettle remained ungrasped, didn’t it?

I have put a lot of thought into what would have happened if the banks had been allowed to go bust, as I have not seen it spelt out anywhere. If anyone knows any good sources, please tell.

From what I know, the following seems to be the outline of the case:

1) We need to distinguish between banks being put into administration and banks defaulting on their debts. It is the latter which causes the problems. They could and should have been put into administration.

2) ALL banks would have been bankrupted. Including the mutuals. They all owed vast amounts they could not repay, and were all deeply inter-connected through ownership of each others securities, right across the western world. Why the Nationwide should have been dabbling in securities god knows, but they were. Why are we members powerless to get rid of the board? – that is a long story.

3) If banks defaulted other businesses would see their reserves wiped out, they could not borrow as planned for investment, and many would be bankrupted.

4) The banks assets would need to be liquidated. These would be mainly mortgages. Who could buy them? The State? The Chinese?

5) People often ask “where was the money?” – it had already gone in an orgy of dividends and bonuses since the Thatcher/Reagan ‘Big Bang’

6) Basically ‘the world’ that Brown claimed to have saved was capitalism itself. As usual the workers paid, and are still paying, the price.

I wish i could hear Bevin’s thoughts on this.

A Labour councillor I knew said the UK would have become like Greece had Brown and Darling not bailed out the banks. He did not reference the claim though.

He was a very silly labour councillor that didn’t know that Britain can never be like Greece because it can issue it own currency – Britain can never go bust.

I’d like to point out that bailing the banks out was only part of the Keynesian approach the U.K. USA and EU undertook at the time, the idea was to create money to fund employment through the resession. It was working pretty good too. Till Cameron got in. They shut it all down and the Austerity phrase caught on like wildfire in elite circles. And that is because very few people understand that a countries finances cannot be run like household finances.

After all the government create money out of thin air and remove it when it’s paid back in tax. The only possible reason for austerity is to make more poor people and the only reason to do that is power and control.

New Labour’s deregulation of the Banks, headlined with the so-called “independence of the Bank of England”, wasn’t in their manifesto and was initially opposed by the Conservatives, but then supported when Michael Portillo became Shadow Chancellor. It was this deregulation that incited deregulation in US. And the deregulation was to facilitate the mickey-mouse accounting to deliver improved public services, through PFI, and join the Euro-currency.

A Bank bailout to save the economy makes sense, but only if they are nationalised and/or regulated to make them servants rather than masters of the economy. Alas due to the revolving door between Banks and Ministers/civil servants, the banks get it their own way and avoided the Icelandic solution.

The Icelandic approach was very good and courageous, but perhaps ironically because they were so small a country, they could get away with it, and that was to say the Banks incurred the debt, so its their problem, not the people’s debt. In effect the Bank Executives carried the debt and were jailed, with other institutions becoming new lenders and being underwritten by the new Government. I.e. Debt cancellation works.

The bailout wasn’t an overspend. Quantitative Easing is merely an asset swap – swapping longer-term interest-paying liabilities like bonds for shorter-term ones like bank deposits. The government essentially bought all that debt for increased liquidity in the banks and then wrote it off, which is totally fine because the government is the sole issuer of Sterling and can never run out. That’s not to say banking culture pre-crash wasn’t a problem and that the government shouldn’t have re-regulated the banks simultaneously because they absolutely should have.

Public debt is just money the government has spent which it hasn’t received back via tax yet (which it will over time – how quickly depends on how high tax rates are. The UK government spends then taxes, not taxes then spends). Essentially it owes the debt to itself so it never has to worry about when or if to pay it back. And as every pound of government spending is a pound of someone else’s income, we really shouldn’t want them to.

S: “And as every pound of government spending is a pound of someone else’s income, we really shouldn’t want them to”

No. Every pound of government spending is a pound of OUR income – and it should be spent on US. There is nothing wrong with that. The real crime is when that public money is sent into the pockets of private companies, landlords, banksters and “investors” – particularly when these same individuals have a special and close relationship with the very same government employees deciding where this money should go.

That’s the problem with people who pretend that a pound spent on public service is a pound wasted. It should, of course, be “given back” to the lazy rich, who will more rightly stuff it into Swiss bank accounts, building a new yatch, or otherwise disappearing it from the system that brought it into being – through labour.

That labour only came about through the Commons – education, infrastructure and civic protections – which would not exist without public spending.

People who hate public spending (which doesn’t benefit their favoured privatised public services) always pretend that businesses exist in isolation to the rest of society, that they really did invent everything themselves. “Society does not exist” – except when it’s the backstop and underpinning of every private enterprise that ever existed.

Well, we were told that the ATM’s would close, and people wouldn’t be able to feed their children. This is still repeated as a ‘truth’ to be unchallenged, but it was never inevitable in the first place.

My guess? An extremely unpleasant 6 months as the economy collapsed depression style, whilst the Government were forced to guarantee everyone’s deposits. I say forced, because it’s a better option than a socialist take-over, in the minds of the establishment. So, house price crash, and high unemployment, with some of us at the food banks. However, the ATM’s would have remained open, and there would be some entertainment to be had watching various bankers cry for their mummies as they are sent down for fraud.

After 6-12 months, a slow recovery. After all, rents and house prices are now at a reasonable level, and whilst a whole bunch of idiots just got hosed, my sympathies for the rentier class will always remain somewhat limited. The positive effects could be immense – after all, those with jobs would suddenly be doing ok, with some spare cash as rents collapse. Some confidence comes back into the economy as there is slow growth.

The banks themselves? The bigger ones nationalised, the rest left to collapse. Not this 50-50 hybrid model that benefited only the banks – but wholly nationalised. With that, a whole bunch of crooks and charlatans could be sacked, and imprisoned for fraud.

This is possibly way too positive a scenario, but it’s not all that bad is it? I mean, it’s all going to happen again anyway, house prices are already about 5x higher than they should be, and a whole lot of expense would have been spared. It always struck me as odd that, within a weekend, the banksters had a fully formed bail out plan, on Gordon Brown’s desk, first thing. As though they knew it was coming, and had prepared emergency measures accordingly. They might have done something years earlier of course, but clearly put this in the ‘too hard’ basket. Crooks, to a man and woman.

“watching various bankers cry for their mummies as they are sent down for fraud.”

But it wasn’t fraud. What they did was not only legal but routine. And investment banking existed long before Brown’s light touch.

If there was fraud it was in the US with the ratings agencies and mortgage brokers but again, they weren’t doing anything they hadn’t been doing for decades.

Once you accept it wasn’t fraud or unusual practice that caused the crash, you’re left with only one possible conclusion — capitalism doesn’t work. It’s fine for consumer good and everyday junk, a boom and crash in the iPhone accessories market isn’t likely to destroy many lives, but when it comes to houses and the fundamentals of an economy, capitalism is highly unstable and potentially destructive.

The interesting thing is it’s happening again. The loans, mortgages, borrowing, consumer-spending bubble is being inflated as we speak. But that’s our economy, it’s all we have in the absence of a real manufacturing base.

It is fashionable for right wingers to argue that the bank bailouts somehow did not really happen, or did not really cost anything. That rewriting of history is gaining much strength in mainstream media narrative.

What nonsense, it was ‘libertarian right wingers’ who rang the bell,first predicting the the crash, then condemning the bailouts.

Look up Ron Paul, Jim Rogers, Peter Schiff and many other similar thinkers from that time , telling the truth then, telling the truth now.

The phony left and the neo con right have a virtual monopoly on bilge distribution, re writing history and the denial of truth.

As for Corbyn and Sturgeon, these two have no idea whatsoever how the real world of finance works either, they offer no viable alternative to the present unfolding disaster.

The only one ever to talk any sense back then was Vince Cable, but that didn’t work out too good either for him or us.

Face it, interest rates of close to zero tell us all we need to know about our future, it’s going to get very ugly, and there’s not going to be a man on a white horse coming in to save the day.

Comparisons with Iceland fail to take the unemployment rate into consideration, it’s currently 2.4%, around half the (official) UK rate and many sectors struggle to recruit which is bound to put upward pressure on wages. The cost of living in Iceland is such that many people have more than one job as well.

Wage growth in France and Germany (which blew about as much on bailing out their dodgy banks as we did) doesn’t appear to be that spectacular, in fact the whole Euro Area looks to be pretty dismal.

Forgot the link.

https://tradingeconomics.com/germany/wage-growth

You forget to take into account that the way that unemployment is calculated is different between one country and another. In Britain, anything is done to get people off the unemployment list. In France they do it accurately.

That’s why the word “official” appeared in brackets but I’m not convinced the French are much more honest about it.

“New Labour were not only responsible for much of the financial deregulation that made the great crash possible. Policies such as the Public Finance Initiative were simply devices for pouring billions of pounds in public spending straight into the pockets of the bankers.” Is this what the Conservative MPs mean every time they say Labour mis-managed the economy? Because it sounds to me very like what the Conservatives did during Thatcher’s time. And now their blinkered and catastrophic austerity economics is yet another way of mis-managing the economy.

You are rightly pointing out that economic policy is more or less unified across the political spectrum (a rather narrow band). The idea of PFI and PPP, were in a certain sense, not an entirely bad idea but at root it was devised as a means of accessing public finances for the private financial sector. The other problem was monitoring and negotiating deals. The public servants were not in any way equipped to strike good deals with the banking and finance offshoots who were attracted to the idea.Essentially the detail of many of the deals is outrageously disadvantageous to the public-(in effect paying far higher ‘interest rates’ than would have been the case in the event of a straightforward loan. The problem was, partly managing the risk. Essentially the financial interests sold products falsely with highly inflated risk elements-when in reality the risk was quite low.

Brown was an utter fool-he was shafted by the banking and finance industries, up, down, right, left, and centre, up his bum, through his mouth, and they even probed his belly button.Brown’s enduring problem is how he managed to spend a lifetime speaking out against the wiles and financial chicanery of the capitalist system, and its impact on social justice, and then let himself fall into their evil embrace without the merest hint of resistance. They had their hands on his willie and administered extreme unction, to him. I wonder if he even knew they were doing it.

Absolutely agree Craig. I think I’m correct that such a level of debt had only been seen twice prior to the crash and that was at the time of both world wars.

Craig

You seem to see constant economic growth as the solution to many current problems. How does this idea reconcile with the fact that economic growth is dependant on cheap energy and other resources and we are running out of these? Or at least they are becoming too expensive to produce. There may be lots of fossil fuel in the earth but net return on energy is getting lower and lower.

Alternative energy, wind, solar, renewables etc., and as long as the sun shines we have a source of energy.

Oil is as much about plastics as it is about fuelling cars.

It’s as much about aircraft, HGVs, merchant ships, not to mention food, as it about fuelling cars.

Economic growth goes hand in hand with a growing population.

Bail outs are nothing new. This essay tells of the bailing out of the East India Company going back to the C17.

Free Trade, War and Debt: All Branches of the Same Tree

by Geraldine Perry / June 30th, 2017

http://dissidentvoice.org/2017/06/free-trade-war-and-debt-all-branches-of-the-same-tree/

Perry also co authored Two Faces of Money.

http://www.thetwofacesofmoney.com/index.php/Main/HomePage

Although the government has always been working for the interests of the banks, your contention that the property price bubble would have burst if they’d been allowed to fail points to another thing that is rotten about the UK and that is that it is a rentier economy. The landed gentry are in charge and will therefore promote land value inflation. I think there’s also been a realisation that the plebs owning property is no longer in their interests as they seek to monopolise property ownership as they can increase their income from charging rent. London is an example of how even the middle class are being squeezed out so that the future for many people is a life renting substandard and insecure tenancies. The corporate media meanwhile will continue to promote the idea that the shortage of affordable property is down to the “hordes” of immigrants entering this sphinctered isle.

I think that was about 1000 years ago.

Nice article. For years we’ve been living in a behind-the-looking-glass world where – despite having all witnessed round-the-clock coverage of the giant bank bailout – we were subsequently informed that the deficit had actually resulted from Labour’s overspending on the poor and disabled. This audacious lie – the justification for austerity – was colluded in by the entire media and political class, including the spineless Gordon Brown and Tony Blair. Had the wagons not been circled around this dishonest narrative there is no way Britain’s very poorest people could have been forced to atone for the sins of its very richest.

It’s something worth bearing in mind each and every time a mainstream media figure is heard dismissing something as “fake news”. One might also recall the lies that led to Iraq and Libya being reduced to Mad-Max dystopias to understand that the British establishment and its media mouthpieces are some of the most unscrupulous and dangerous purveyors of fake news on the planet. There’s no need to conjure up conspiracy theories about them. Just look at what they’ve done in plain sight over the past fifteen years.

People need to get out of this “austerity” trap. We’ve had barley any austerity technically. Why they like “it” so much. We’ve had cuts and privatisations. Those are the significant issues in this country. Repeating “austerity” over and over again is what they want, Because they can show they haven’t.

We are led down a false narrative in order to undermine us and show we really don’t know what’s going on.

Im actually shocked how may seemingly intelligent politicians have no Idea about this system. Ones who don’t hesitate to tell me I I’m not informed.

Excellent post Craig and a subject close to many hearts.

I had hoped we had moved beyond smearing Brexit voters as racist. Many working class people were being screwed over by unfair competition where wages were driven into the ground and they were put on zero contract hours in a gig economy. Inflation was rising and wages weren’t moving. These people were largely ignored and treated with derision and called ‘racists’. They weren’t racists, they were poor and getting poorer and were skinned to the bone through neo liberal politics.

Mark Blyth explains this better than I can :-

https://youtu.be/rGvZil0qWPg

Several million people now in the workforce on ZH contracts, lower than minimum wage workers and apprenticeships rightly no longer make any significant tax contributions. These are the 30% Mark talks about no longer having political representation because they are too poor. Shocking state of affairs. The ever increasing deficit as shown by the UK current account in both goods and services combined with £42B in debt servicing will require a new re-industriallisation revolution and minimum of a decade to turn this around. This is required regardless of Brexit or Remain in the EU. I believe the rot set in with Thatcher and has continued with successive red and blue Tory governments. Privatisation of state assets has resulted in the family silver being flogged off and despite the free market and competition the consumer is paying significantly more for their utilities than they have had corresponding pay increases ( so too with rent).

People turning to populist policies and leaders is the only hope they have but sadly will likely be let down by. The future looks anything but rosy until people in power grasp these nettles and begin to make radical changes in our business model. Alternatively the electorate must change the people in power.

Indeed David. But the developments you refer to were not caused by the EU and were not caused by immigration. The elite who benefited from those policies managed to distract the political anger from themselves by focusing it on immigrants. Capitalising on popular racism.

“left wing” Brexiteers like to focus on things like zero hours contracts – which are nothing to do with the EU – and make claims like “the EU would block nationalisation of rail services” – complete rubbish. All just a smokescreen to hide the fact that at base the vast majority are only responding to the anti-immigrant racist dog-whistle. Mostly hiding that fact from themselves.

We cannot move beyond the “Brexiteers are racist” argument because it is profoundly true.

The fact that Germany, Holland, the Scandinavians and Swiss have successfully managed their economies and have surplus current accounts confirms the fact that the cause of UK’s demise was not the EU or immigration per se. As I said above I hold successive governments to account for this though of course the media have exploited this to the detriment of our relationship with the EU. There have been some specific examples though of jobs being replaced by eastern european workers on half the hourly rate. Again not necessarily an issue of the EU free movement policies but of unscrupulous business owners looking to make a fast buck. Again these stories didn’t help the case for staying in the EU.

Another insightful, well-written article, however I find some of your posts in the ‘comments’ section a bit alarming. I voted ‘Remain’ but I did so believing that we could and should reform the EU, and not a single one of my concerns had anything to do with immigration. My concerns were/are:

-The EU functions partly in an undemocratic way (the appointed commission)

-EU laws prevent us from having full control over VAT – a regressive tax

-EU competition laws make it extremely difficult, although not impossible, to nationalise industry, however why should we accept that our industries should be extremely difficult to nationalise?

-The inability of the democratically elected Syriza government to implement their manifesto was partly (but by no means entirely) caused by opposition from the EU.

Immigration enriches our society. I was utterly appalled by the ‘Leave’ campaign’s approach to the referendum, but I believe that there are some socially just reasons to leave the EU. I’m also aware of many people within the SNP, Scottish Greens and Scottish Labour who feel a similar way. Characterising people with these concerns as being ignorant of their own racism will not help us to move beyond the monopolisation of the debate by, on one side, people who regularly and directly enjoy the benefits EU membership and, on the other, aspiring demagogues like Farrage who whip up racism in order to divide the population and stymie progressive change.

There are more voices in this debate that need to be heard if we are to move forward, and a left-wing concern with EU procedures is one of them.

Your concerns are interesting;

-The EU functions partly in an undemocratic way (the appointed commission)

The commissioners are appointed by national governments. Actually not a lot happens in the EU without the consent and approval of all national governments and that’s why just one EU member could veto and block any brexit deal. If anything the EU is too democratic, I would say.

-EU laws prevent us from having full control over VAT – a regressive tax

VAT rates vary across the EU even now, after the Euro. Something like 1.5% of the VAT you pay goes towards paying for the EU. You could stop that and raise the money in other ways if you wanted to but one way or another you need to pay towards the EU which when you look at the benefits of membership is worth paying for in my opinion.

-EU competition laws make it extremely difficult, although not impossible, to nationalise industry, however why should we accept that our industries should be extremely difficult to nationalise?

If it is difficult to nationalise industry in the UK, I think it is obvious that the causes of that are closer to home. Even the so called left (Labour) in the UK are ideologically opposed to nationalisation except in very unusual cases. the UK has been in the grip of an extreme right wing anti-nationalisation frenzy for about 35 years; I hardly think the lack of nationalised industries is down to The EU.

-The inability of the democratically elected Syriza government to implement their manifesto was partly (but by no means entirely) caused by opposition from the EU.

Everybody blames the plight of Greece on the EU. Actually though it was the IMF who managed the Greek crisis and imposed conditions on the bail out. Being in the Euro requires that no member does anything that is detrimental to the whole. How would you like it if Scotland started printing billions of pounds and undermining sterling?

Public and private debt is now around 650% of GDP. Thats second only to Japan. The wonderful financial services sector which contributes about 18% to GDP and we are afraid will disappear with Brexit has a 450% debt to GDP all on its own.

In my experience in industry at the time Ireland reduced its corporation tax my company relocated some administrative staff and its mail box to Ireland to take advantage. The directors and senior management however kept their homes in the leafy suburbs of west London. I expect the same thing to happen with the banks and Brexit.

Laughably central banks are talking about raising interest rates at a time when private debt is at an all time high. They won’t raise them for long!

Why?

Simply because people are too indebted. House hold debt sits at £1.6 trillion.

Think about people’s disposable income already being squeezed due to large mortgage payments. What happens when the payments increase? You get defaults.you also get a further decline in spending.

In the macro economy spending=income and so the spiral of decline begins..

The truth is its all about the Euro and if people had voted Remain, UK would now be heading for membership as part of EU monetary union to solve the Euro crisis and to create the super-state.

Its seldom mentioned and wasn’t mentioned in the EU referendum, but both Labour and Conservative had previously promised to hold a referendum on joining the Euro-currency, due to the influence of Sir James Goldsmith’s Referendum Party (the UKIP of their day), hence why the mickey-mouse accounting and austerity was needed and continued by Chancellor Osborne until Brexit, to keep within the rules for joining when it became political possible to do so.

Indeed I’m sure we would have been told the Remain vote trumped the earlier promise to hold a referendum on joining the Euro.

Complete and absolute rubbish. Almost nothing to do with the Euro. Post your brainless xenophobic rubbish somewhere else.

Is it xenophobic for Scotland to leave the UK?

Only if we did it xenophobically.

Which under “hate crime” laws can be based on perception by a third party!

The 1997 New Labour manifesto was to join the Euro-currency and therefore its safe to conclude their economic policies, including the extensive use of PFI, would be driven by that policy objective, including the so-called “independence of Bank of England aka deregulation of the banks, that wasn’t even in the manifesto.

Dave

You make some valid comments. Had the referendum vote gone to remain there was no plan for remain either and still turmoil would have ensued. Neither was the remain side of the argument costed in any way to take account of the continued investment UK would have had to make both in the EU and to continue to respond to uncontrolled immigration and its impact on infrastructure and public services.

“Chancellor Osborne”

I hear he did do some austerity, then stopped it. Are we out now then?

I think it’s nonsence that we have ever been so subservient or controlled by the EU. Well within the bounds of what the traditional elite want, just not enough powers to exploit people. …Have them burn to death.

I think they want more of those circumstances. That is certainly the main motivation behind the elite who bought the “brexit” choice about. Now we are going to turn it around.

(This is on point, please read to the end)

There are clearly those (like yourself) working for some kind of “just” “equilibrium” of the system. But just like slavery itself was wrong and not just material conditions slaves lived in, power in this society as embodied (ultimately money/market dominated thing) is unjustifiable.

I don’t want, and we can’t use, that which can and will be taken away again. In fact I think it’s a necessity for human survival that the very basis of social relations is fundamentally changed.

There were never any “good old days” and you can’t just staying in your box and think your “progressive” just because everyone else moves “right”. Whats actually progressive isn’t still (not if you think individuals learn about stuff and make better choses anyway) And certainly doesn’t exist within dreams of a system that never did serve people well at the best of times, it just moved along without much resistance, tearing up the earth, sucking out pollution to sell to others. Bonding us to it.

Of course the “private” banks should not have been fed cash by citizens they are MEANT to serve. It’s certainly killed a lot of them. But they were always a bomb waiting to go off.

I think what’s hidden by banking/markets is that we all still need to consider human survival. And that while nothing is without consequence all the stuff we have is free. Comes from free stuff. The bounty of nature, “externalities” to all good economists.

The body of nature is also us. We aren’t separate. Full stop.

& ps, That is not “Scotland’s oil”…

Not 10 years ago but 20 when Blair was still talking to Brown the US model was being suggested for the UK and Europe & RoW

page 5 of pdf below (Doc is searchable – on my machine “ctrl + F” a search box comes up – type “Brown”

https://clinton.presidentiallibraries.us/files/original/5aa4876f138a60330e869d23b372880d.pdf

These phone calls are fascinating and ;

Expose Clinton playing Blair like a fish, towards the end Blair honestly believes he came up with the ideas

How the destruction of Iraq came about – type “Iraq”

How Clinton managed the IRA talks – type “IRA” or names that were involved in the process. In fact IRAN comes up when you type IRA, thats interesting too

+ lots more

[Mod: Caught in spam filter, time stamp updated.]

I believed at the time the banks needed bailing out for the sake of the economy.

Now I see it was a political decsion. Labour would have been crucified if they had not done so. They were still crucifed as the conservative saw an opportunity to pounce and blame the crash in labour when in fact they were fully in support of labours policies which ensured a steady flow of.money to businesse paid by the taxpayer. That stupid remark about there no money being left during the handover of power on,y helped the conservatives pursue austerity, which they had always intended to do.

Never one to waste a crisis, and always the first to spot a money making endeavor , the Tories saw their opportunity to force austerity on the rest of us while they would pocket the enormous sums of money floating around the economy because of quantitative easing.

Both major parties had forgotten what they are they for which is to serve the country and not themselves .

But the conservatives are set out to complete the final transformation to a mini US state

In a strange way Brexit has called a screaming halt ( temporarily) to their plans as sections of the British public have started to pay attention to politics at last.

The pause is only temporary though so Scotland needs to get out while we can and make sure their hands are kept well clear of an independent Scotlands economy for they will wreck it first chance they get.

My preferred option was always our own currency. Its obvious now that it is a necessity.

“force austerity in the rest of us”

Minor issue. The major is drive is of deregulation privatisation and cutting (ultimately into none existence) all social programs. Exempt ones that serve these parasitic institutions full of rich people. Seems to me to accept the framework (imo why it was embraced by the rich elite) is the important bit, the idea of society it embodies, perpetuates,…..Horrifying political possibilitys we see the results of.

This is no such thing as “your own” currency, Any more than an “independent” Scotland. Sure you can change the form, but that’s not inherent in any of these ideologies.

Such vast sums which went to the banks can only be recovered by those who got the money; the banks, bankers and shareholders. Those sums can not be recovered from the poorest who austerity is aimed at, those on less than £30K and who use more public services. Passing them the debt means it can never be paid off and can only increase, while cutting services only saves money but doesn’t earn it.

The solution would have been something socialist but at the time we only had right wing and more right wing.The borrowed money should have first passed to the people in lower income taxes and VAT; price caps on food, rent and fares and cuts on rates etc; higher pensions and benefits; and public spending and job creation. Much of the money turning over would reach the banks by day’s end.

Thousands of unskilled jobs can be created by putting conductors back on buses and trains and keepers in parks. Jobs we did have.

Depends what you mean by globalisation. The trouble is what we call globalisation is not a neatly compartmentalised economic model. The one all of us are familiar with and experiencing, to our infinite detriment, aka americanisation, is a ghastly blight on the world, without redemption. You have only to look at the USA’s stirling postbellar accomplishment in turning Italy into a subjugated American theme park for an early glimpse of what was to accelerate from the seventies on. Germany was an interesting case, only saved from a similar fate by the accident of being split and therefore having a large fraction out of reach of the blight, and therefore immune. Though little recognised, that quirk of fate has saved Germany so far from becoming an Italy or a Japan (or, imminently, a France). Five-eyes puppydog Britain is a different case, walking largely willingly over the Bridge towards the gallows and exceptional bliss.

It betrays an extremely narrow field of vision (and perhaps agenda) that deregulation is separated from the many other facets and saddled alone with the blame. Perhaps there are other kinds of globalisation than the stirling US monocultural model, but they certainly are not being effected, nor even considered seriously.

You’ve got to admire Iceland’s approach to banking and financial failure, if only Britain’s MP’s and Lords saw it that way.

I not sure if MP’s and Lords for that matter, have to declare their business interests in Britain, I think they do.

The unelected, undemocratic House of Lords, is stuffed full of people with business links, interests, who’s to say, banking and the financial sector aren’t among those interests.

Sadly some British banks are still failing stress tests, watch out for the next crash, in Britain at least, could Brexit become a contributing factor?

https://www.ft.com/content/85bab29e-b6ca-11e6-961e-a1acd97f622d

Don’t forget Deutsche Bank too which represents about 83% of German GDP. They’re not out of the woods yet.

Funny how this is tying nicely with Austerity by Mark Blyth.

Why is that funny? I haven’t ever read Mark Blyth, but as the perceptions are pretty obvious if you think about them, it is not strange if Mark Blyth’s thoughts have been similar to my own.

You have twelve years of blog here where you can trace the development of my thought. Knock yourself out.

People misunderstand austerity. Our economic models is based on consumer spending/demand and borrowing, not manufacturing. It’s the same in the US.

If the government makes life easy for people at the lower end of the market, guess what, they won’t borrow as much. Note that consumer spending and borrowing are the same thing in essence, you basically buy a loan when you think about it.

We’ve had austerity for decades under different names because we have had an economy based on borrowing and consumer demand for decades. They go hand in hand.

Imagine you were in the loans business, your margins and livelihood depended on giving out loans, how would you feel about a massive player in the market giving people money for nothing? At least, that’s how they see it. Certainly if people at the bottom had more benefits etc., jobs, better services, they’d borrow less.

It’s a wonga economy. If people are desperately poor and deprived they will borrow and there’s huge profits to be made there. As they see it, nobody makes profits out of feeding the poor and making life easy for them, that’s a waste of money not a way to make it.

And that’s where austerity comes in and it’s why they love it so much. It’s highly profitable. Who wouldn’t go out and borrow if their kids were hungry or needed shoes? It’s basically a serf system at its core, medieval in essence.